Insurance For Damaged Items While Shifting

When you are moving your things from one place to another, the damage is sometimes unavoidable. You would have to either replace it or repair it from your wallet. This can be avoided if you have insurance for the goods. It is always safe to insure your goods before you move them. But there is a catch to each and everything you insure. There’s an article on the tips you could follow to get the best out of your insurance. Remember, you’d be able to claim only if the goods have been damaged in transit.

Once you have received your insured goods and find them damaged, here are some pointers to get your claim:

Criteria:

Each Packers and Movers have their criteria and terms for insurance claims. Here are a few criteria that apply for almost every carrier out there:

- Pack the goods after knowing the criteria of the movers or let them do the packing.

- Within 14 days from the delivery date, you would have to submit your claim in writing via e-mail or courier.

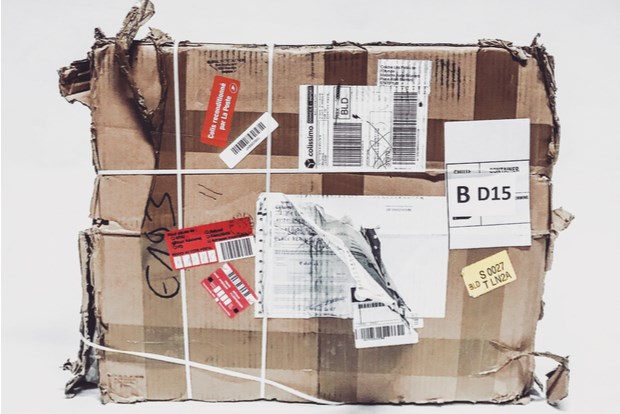

- Include photographs of the damaged goods and packaging along with your claims form. Only after reviewing the evidence of damage, an inspection will be arranged if needed.

- Do not move the goods from the delivery address or open the packaging. If you open it or move it, the company will conclude that the damage has occurred after the goods were delivered and your claim will be rejected. It would become difficult to determine that the damage was done during transit.

Claims Liability:

You can claim the full amount if you have purchased enhanced insurance for your goods. You would still have to provide damage evidence that the repair replacement cost is not lower than the cover you have purchased. Suppose you don’t have an enhanced insurance cover protecting your goods, you would receive the standard compensatory amount which would be around Rs.5000.

Enhanced Cover Exceptions and Conditions:

You can receive full compensation if you have complied with the above criteria. But it is also important that you know about the conditions that would prevent you from getting the full cover:

- If the replacement cost is lower than the insurance compensation.

- If the repair cost of lower than the insurance compensation.

Why a damages claim can be rejected?

When you pack the goods you need to have in mind the rest of the journey it is going to take. Most of the rejections stem from the fact of insufficient packing. You goods will be loaded and offloaded many times, put on vans, truck, conveyor belts, and x-ray machines. Your packages will be stacked upon. So the packaging should be done accordingly. Your claim will be rejected if:

- The packaging is unharmed but the goods inside are damaged.

- Insufficient cushioning of objects inside the box.

- Contents are too heavy for the packaging.

- Joints and openings are improperly secured.

- You fail to submit the claims form and sufficient evidence of damage within 14 days from the delivery date.

- Upon delivery, you fail to sign it as ‘damaged’ or ‘unchecked’.

- The damaged goods aren’t on the compensation list.

Procedure for the claim:

- Submit photographic evidence and supporting documentation of the damage such as pictures of external packaging which shows dents and tears, internal packaging which shows how the items were packed, and pictures of damaged items.

- Submit the purchase receipt to show the value of the object. If you have any additional documents (whether you have used the original manufacturer’s packaging) that confirm the damage to your belongings.

- The insurance company will review the evidence that you provide and respond within seven working days and sanction a damage inspection if required.

- If an inspection is sanctioned, the company which delivered your package will collect it within 5 days and conduct the inspection. They wouldn’t hold on to your package for more than 5 days. (Note: The package shouldn’t be moved from its delivery location or unpacked)

- If your claim is rejected, the insurance company will furnish you with a full explanation of the rejection.

- You can appeal further if you can provide additional evidence apart from the ones you have already provided.

- If your claim is accepted you would have to fill the claims form and return it within 14 days. The form should include an invoice of repair cost is the goods are repairable or an invoice if the goods are irreparable.

- Your claim will be processed within 14 days.

You can sidestep the whole process if you hire the best packers and movers in your city and if you still find your goods damaged, you can get advice from expert insurance providers.

Post a Comment